After seven years, the Swedish company shows an operating profit and makes the Stockholm financial market celebrate. The stocks go up 22.83%

AROUND THE WORLD IN 80 DECIBELS

Halloween is widely celebrated in Sweden, but on October 31st this year the Swedish audiobook platform Storytel seems to have exorcised most of the evil spirits and ghosts of the island of Riddarholmen in Stockholm, where the company is headquartered.

At least, that was the general feeling when the company’s interim report for Q3 2023 was made available in the morning of Halloween, followed by an online presentation of the results conducted by Storytel’s CEO Johannes Larcher and its CFO Peter Messner. The figures are in fact very positive and no evil spirits could survive the overall numbers. The Stockholm financial market watched Storytel’s stocks rise 22.82% during the day, basically recovering the loss it suffered when Spotify’s audiobook program was launched in the beginning of the month.

Overall, the streaming revenue was up 13% to 842 MSEK, compared to the third quarter of 2022. The group net sales increased by 11% to 896 MSEK, and the EBITDA increased by 55% to 92 MSEK. But the real holy water for the market was perhaps the operating profit of 15 MSEK – the last time Storytel had an operating profit was in 2016.

Profit-oriented after Larcher took over

For anyone who has been following Storytel in recent years, this is not a surprise. Actually, what is rather surprising is the low market value of the company in the Stockholm stock market. Basically the company completely changed its strategy after Johannes Larcher took over as CEO, implementing a profit-focused management and distancing itself from the growth-and-expansion approach adopted by Jonas Tellander, Storytel’s founder and CEO until February of 2022. And the truth is that Larcher is delivering what he promised, to a point that several analysts congratulated the CEO when asking financial questions at the investor’s call. It felt like a party, but with no drinks – perhaps because it was too early for that.

But the purpose of this column today is to focus on the global audiobook market as a whole, not so much on Scandinavia. So the question at the end of the day is: What does this profit-obsessed successfully applied strategy mean to non-Nordic countries where Storytel is present?

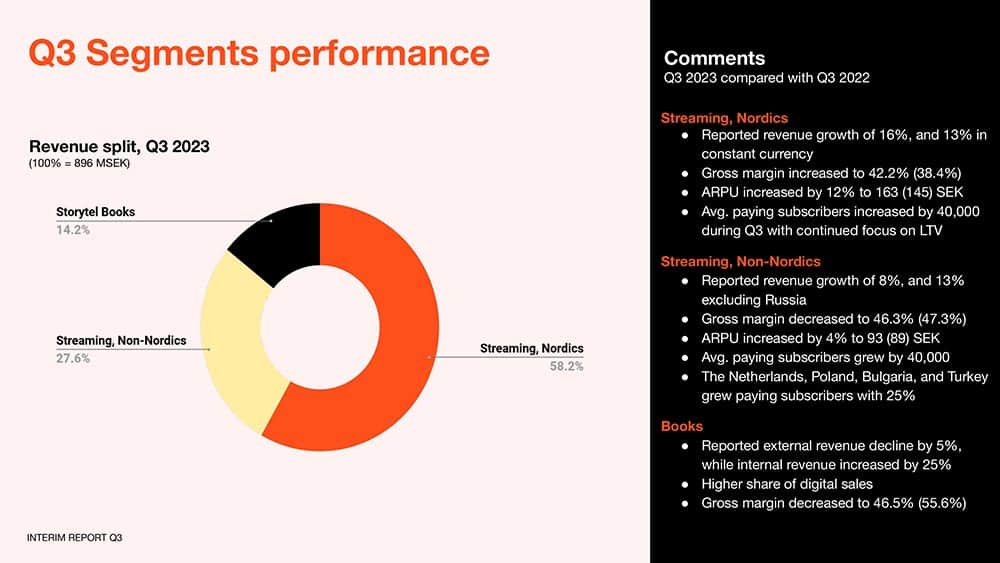

First, let’s focus on some of the numbers shared in the report for context. Non-Nordic streaming revenues represented 27.6% of Storytel’s revenues in Q3 2023. It is much less than the Nordic streaming contribution of 58.2% but almost twice the revenues coming from the traditional print publishing segment, Storytel Books, that responded for 14.2% of the 896 MSEK total revenues.

In terms of paid consumers, Storytel had 1.169 million users from the five Nordic nations – don’t forget Iceland! – and 975 thousand customers from the rest of the world.

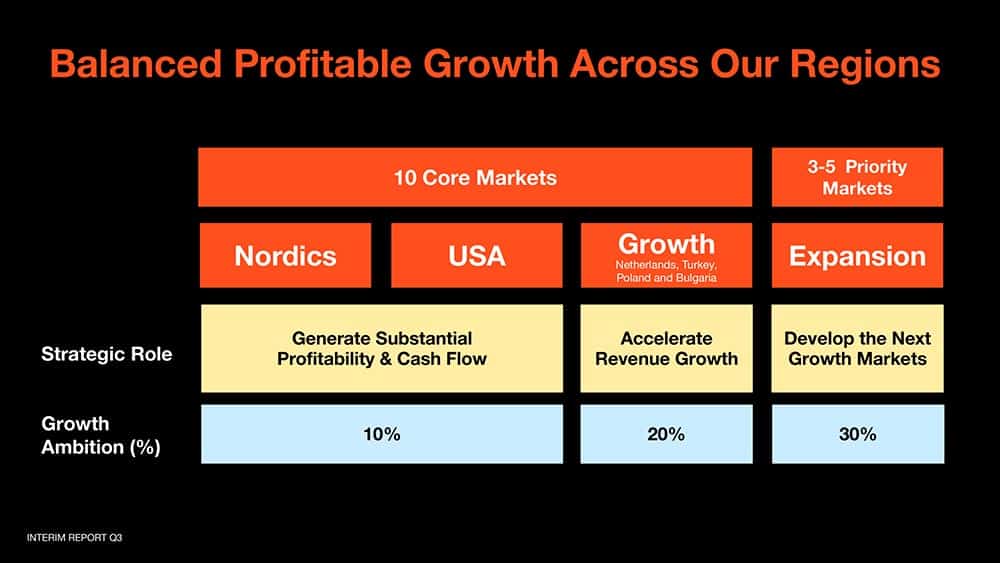

Second, we need to recall how Storytel divides its markets. They have selected 10 core markets to concentrate most of their attention. They are the Nordics (Sweden, Finland, Norway, Denmark, Iceland), the US (where they control audiobooks.com) and the four so-called growth markets: Netherlands, Poland, Bulgaria and Turkey. All the other markets, including Germany, Italy, the Spanish and the Arab worlds, are part of what they call expansion markets. And these markets have suffered a huge divestment by Storytel, even though the Swedish company is still operational in them. ”Almost all of our investment in content, marketing and personnel is focused on a modest number of just 10 core countries”, nailed Larcher during the investors call.

But for now, I would like to leave the Nordics aside, perhaps for another column, and focus on Storytel’s plans and take on the other markets.

Starting with the four growth markets, it is fair to say that they got some good attention in the reports and in the remarks of Johannes Larcher when addressing investors and financial analysts. One of the highlights of the report, for instance, was the partnership with the telecom Yettel in Bulgaria, which offers more than 3 million potential users to Storytel, and that was launched last September. According to the report, the deal is ”already showing promising signs from a paybase growth perspective”. By the way, the customer base growth in Bulgaria, Poland, Turkey and the Netherlands was 25% on a year to year basis. Considering that the total Storytels consumer base grew about 80,000 subscribers from Q3 2022 to Q3 2023 and that, according to the report, only half of this growth took place in the Nordics, the actual growth generated in the four growth markets seems to be indeed relevant.

”In the four European growth markets, we are currently accelerating revenue growth and, in the past year, have exceeded our annual growth ambition of 20%. Based on our strong position in these four markets, we believe we can maintain and accelerate growth in the years to come”, said a very optimistic Johannes Larcher.

Netherlands and Poland will grow

I believe we should really keep an eye on the Netherlands and Poland, particularly. According to some reports heard in the audiobook marketplace, Nextory, another Swedish audiobook company, is doing extremely well in the Netherlands. And Poland is a very dynamic market where Bookbeat (ah, those Swedes againI) seems to be getting some traction while local Audioteka is now full-focused on keeping its significant market share after a period of turbulence among its equity owners. Bulgaria is obviously relevant to Storytel given the partnership with Yettel, and Turkey has always been a serious potential market given its population of 85 million souls.

But what about the so-called expansion markets? The list is huge – you can always go to www.storytel.com and click on the country list on the button located at the right corner of their page – and includes once potential markets such as Brazil, the Spanish world and the Arab countries, which now receive very little investment from Storytel. The list also includes countries like Germany, which portrayed a 300-million-Euro audiobook market in 2022.

”Since my arrival at Storytel a bit more than a year ago, we have dramatically reduced the level of investment in our expansion markets. At this point, very limited resources are applied to content, marketing, and personnel investment in these markets. Collectively, they account for less than 10% of our total revenue. And we have, for the last months, further tightened our focus”, said the CEO Johannes Larcher. But then he surprisingly added: ”Today, you see markets like Korea, Italy, Brazil and Germany growing their subscriber base with minimal investment.”

Almost stagnant Arab audibook world

This subscriber base growth, happening despite inexistent investment or even local teams, is probably related to the fact that audiobooks have very low penetration in these markets. Still, it is quite a surprise for Germany and Italy. And Brazil will be interesting to watch after Audible opened shop there in the beginning of October. But despite the lack of investments, Storytel’s goal is to grow 30% in the expansion markets by 2026. I believe this is quite a challenge given this context. Maybe that is why they brought an accomplished Brazilian executive, my countrymate Ana Julia Ghirello, aka A.J., to oversee such territories. For tough missions, you need to call a Brazilian!

But jokes apart, the development of these markets by Storytel would be very welcome in all these local markets. Today, the Arab world is almost stagnant. The Spanish territories are almost void, particularly in Latin America. And smaller places like Indonesia, Israel, Singapore and Thailand are obviously doing less than great with Storytel’s divestment. So let’s hope Storytel finds a way to invest and develop these markets in a sustainable way even in the short run. Fingers crossed.

Don’t mention Spotify

Now, what about the US? The elephant in the recording studio has a very clear name: Spotify. And, yes, it is another Swedish company! In the beginning of October the music giant announced that Australian and UK prime subscribers would now have free access to 15 hours of audiobooks from publishers like Penguin Random House, Hachette and Dreamscape. And the offer will be expanded to US prime users sooner than later.

So what is the take of Storytel on Spotify’s competition? Johannes Larcher made sure he commented on this matter when answering questions at the investors call, focusing first on the US market as a whole, where Storytel is present through audiobooks.com.

”In the US, we are satisfied with the development of the subscriber base; we are certainly optimizing this business for profitability and, therefore, the subscriber growth alone is not the most important dimension we are running the business against”, said the CEO, before commenting more specifically on Spotify:

”Nothing in the announcement that Spotify made was a surprise. It was fully expected on our part that Spotify would increase their interest and participation in the audiobook business. And I think this is actually a good thing. Think about the US market, with 320 million people, 270 million consumers above the age of 18. And you have an audiobook penetration that is 2 to 3%. So I believe that Spotify’s entrance into the US market will accelerate the market penetration and lead to more recognition of the category and the value that this product can provide to the consumers at large scales”, declared Larcher.

The head of Spotify, however, showed skepticism to Spotify’s current model. ”I am doubtful that what you see in terms of the Spotify offer launched in the UK and Australia today will be the ultimate offer you will see a year or two years from now. Just given the content licensing relationships and the unit economics, I think that there will be changes. I don’t think that getting 15 hours of high quality audiobooks included in a 10-dollar premium service is economically sustainable for the long term.”

Optimistic about North America but …

Overall, Storytel seems to be optimistic about the American market, but also a little resigned, in my honest opinion. ”We believe we are well positioned to compete with Spotify. Not only in the Nordics […], but even in the US. Think about the size of the market – this is not Sweden, this is 40 times as big as Sweden. There is lots of room for smaller players to have a position in the market that can be profitable. We believe that even with Spotify’s entry, and with some optimization and tweaks we will be making in the business at audiobooks.com, we will continue to operate profitably at a small scale, admittedly, in the North American market”, said Larcher.

The arrival of Spotify in the English markets is a very welcome and necessary relief to Audible’s semi-monopoly. With a competitor like Spotify, Audible will do better and everyone will win. Competition will be very good for the market. That said, I once hoped that Storytel would eventually try to bring audiobooks.com to the big dog fight. Perhaps I am just being naive, but it would be great to see Storytel desiring and conquering more relevant space into the English markets. Of course, the focus is on profitability now, the Stockholm financial boys are happy and you have to choose your fights. I just hope that very soon Storytel starts to pick bigger fights both in the US and in the expansion markets. (And, yes! While keeping a decent operating profit!)

Text: Carlo Carrenho

The column Around the World in 80 dB is published biweekly and focuses on the global audiobook market, bringing both worldwide and local news and analytics.

Carlo Carrenho is a publishing consultant based in Sweden and the co-founder of Pop Stories in Brazil. He was the Frankfurt Book Fair’s Audio Ambassador in 2023.